Investing.com– Morgan Stanley (NYSE:MS) analysts said they continued to recommend Japanese equities over China, citing increased growth concerns for the latter, especially in the face of fresh trade headwinds from the U.S.

MS said it was Overweight on Japan, Australia and India, and was Underweight on China. Its preference for Japan was furthered by recent weakness in the yen, given the country’s high concentration of export sectors.

Trump was declared as the winner of the 2024 presidential election on Wednesday, sparking a rally across global markets. But Chinese markets lagged, given that Trump has vowed to impose steep import tariffs against the country.

MS said any higher tariffs were “likely a negative from a growth perspective.” The impact of the tariffs is also expected to undermine the economic boost from any major stimulus measures from Beijing, MS said.

China’s National People’s Congress kicked off a four-day meeting earlier this week, with the body widely expected to outline plans for more fiscal support for the economy. An announcement is expected by Friday.

Chinese markets had surged in early-October on the prospect of more stimulus measures from Beijing. But the rally cooled in recent weeks, amid doubts over the scale and timing of the planned stimulus.

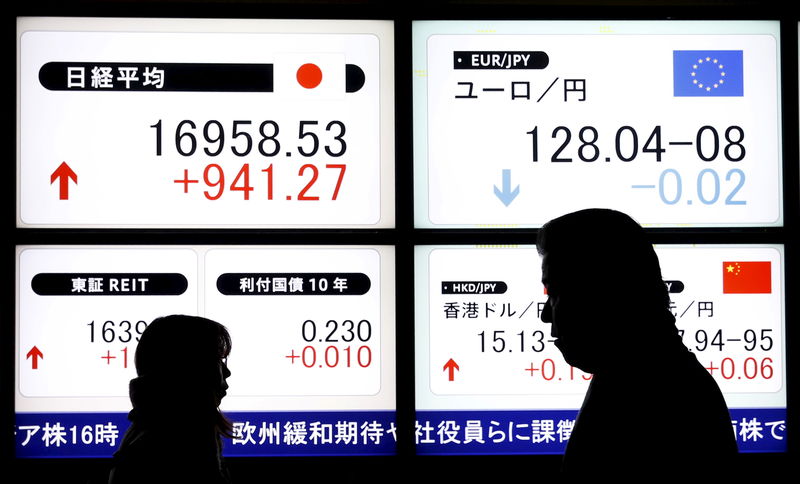

Japanese stocks rallied sharply after Trump’s victory this week, as the yen plumbed three-month lows against a robust dollar.